There’s a partial solution to the housing crisis literally sitting right under our feet.

This solution doesn’t require years of approvals, large slabs of finance or the demolition of valued character areas to proceed.

It just requires some smart thinking in regard to government policy and taxes.

And what’s more, this solution can be in place in a matter of months, not years.

It’s called existing housing.

The penny is finally starting to drop that new housing supply is not enough to solve Australia’s housing affordability issues.

And what’s more, given the significant constraints in the building industry, and potentially buyer reluctance to purchase new high-rise apartments, supply is a solution that is struggling.

In August, the NSW Parliament Research Service published a paper called The economics of housing supply: Key concepts and issues. It was authored by Rachel Ong ViforJ, PhD Professor of Economics at Curtin University and Chris Leishman, PhD Professor of Property and Housing Economics from the University of South Australia.

“The policy focus in Australia is on new housing supply, but it is existing housing stock that forms the majority of total housing stock, and therefore existing stock potentially plays a more important role in shaping affordability outcomes than newbuild housing,” the paper says.

Bingo.

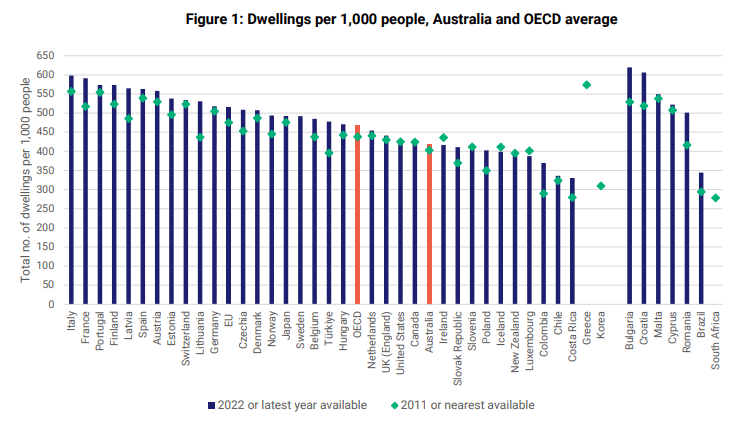

The paper compares Australia’s housing data with that of the 37 nations in the Organisation for Economic Cooperation and Development (OECD).

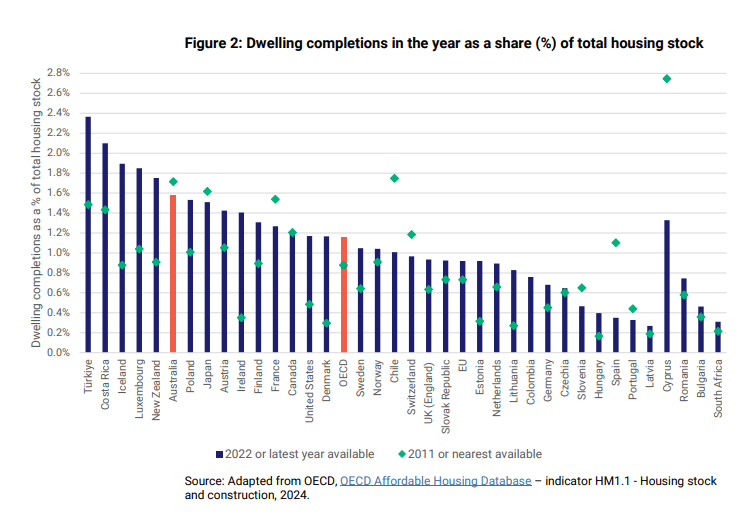

It says that, in 2022, Australia was doing well in new supply, producing 172,000 new homes which equated to around 1.6% of existing housing stock, and beating the OECD average of 1.2%.

However, Australia is behind the pack when it comes to the number of existing homes which are available for 1,000 residents. In 2022, Australia had around 420 dwellings per 1,000 people, while the OECD average is 468.

Looking at recent data, the paper says “while there have been periods of undersupply of new dwellings relative to population growth, there have also been periods of adequate supply when new housing supply has kept up with population growth.”

“This suggests that problems within overall housing supply do not only stem from an inadequate flow of new supply, as is commonly assumed in policy discussions. Housing supply problems can also arise due to inefficiencies in the utilisation of the existing housing stock.”

Even the NSW Productivity Commissioner, known for a strong pro-supply stance, referred to the need to better utilise existing homes in his recent research paper.

“Building new housing is only one way to increase housing supply. Another option is to use the existing stock of housing more efficiently. Some estimates suggest that there are around 15,000 vacant dwellings in New South Wales

“Other dwellings may also be under-utilised, for instance, where a home has more rooms than the household requires.”

So what are the solutions?

Well, as it turns out, they are everywhere you look.

Granny flats

Currently, if you rent a room or part of your home out, or rent out a granny flat in the backyard, you could be exposing your family home to capital gains tax. The only capital gains tax exemption for granny flats relates to pensioners or people with a disability paying non-commercial rent (in other words allowing a grandparent or disabled family member or friend to stay in the flat for nominal rent).

While it would cost money, a change to tax policy in this area has the potential to encourage millions of Australians to rent out spare bedrooms or build new boarder accommodation.

This change could, for instance, allow a person to rent out any granny flat or room to any person, and not incur capital gains tax on the family home.

Pension asset test exemption

Australia’s pension system is also a problem. It provides a specific incentive for elderly Australians to stay in the family home, because they are worried about an equity release from downsizing will see them lose the pension.

This is resulting in hundreds of thousands, if not millions, of unused bedrooms caused by single elderly Australians rattling around in redundant five bedroom family homes.

The ALP Rudd Government in its 2013/14 Budget actually proposed to trial a scheme which would allow downsizers to be able to exempt $200,000 from the sale of their family home from the pension assets test. This would, in other words, make it easier for older Australians to downsize and still receive the pension.

The measure however died in the Abbott-Hockey razor gang budget of 2014. The ALP is back in power in Canberra – so why isn’t this policy?

Stamp duty

Another problem is stamp duty. A concern about paying stamp duty, particularly among older Australians, stops people from moving to more suitable homes, contributing to the empty bedroom problem referred to above.

As noted Ong and Leishman, the Census shows that more than 200,000 dwellings in NSW had spare bedrooms in 2021, which points to under-utilisation of the existing housing stock.

On the other hand, households in nearly 130,000 dwellings needed extra bedrooms, suggesting overcrowding concerns.

“Overall, these reflect a mismatch between the space needs of households and the dwellings they occupy. While older people who trade down can free up larger homes in the existing stock for younger growing families to trade up to, this exchange process is often not smooth,” the Ong and Leishman research paper says.

“A lack of suitable and affordable housing in the local area and the need to pay stamp duties when trading up or down can hinder this exchange process.”

Demolitions

Then there’s demolitions.

The rate of home demolitions has been rising across Australia, while the rate of home commencements has been falling. In NSW, in March 2024, one home was demolished for each five homes commenced. This compares to around one demolished for ten homes commenced in March 2017.

Since 2009, house demolition has been able to be achieved via a private certifier, if the home is not heritage-listed or in a heritage conservation area. There is no requirement to re-build a new home within a certain period of demolishing an existing home.

It could be possible to add conditions to complying development certificates for demolitions, requiring construction of a new home within a certain period of demolition. This would reduce the amount of pointless demolitions which are simply taking homes off the market.

Other solutions

There are a myriad of other possibilities, including the three below suggested in the Productivity and Equality Commissioner’s report, namely:

- Incentivising homeowners to rent out spare bedrooms, by providing tax relief on rental income up to a certain threshold (similar to the ‘Rent-a-room’ scheme used in the United Kingdom).

- Allowing student accommodation to be used for other purposes when not in use by students, such as for short-term rental accommodation for holiday makers during the summer months.

- Efficient policy interventions that encourage long-term rentals over short-term rental accommodation.

And there’s other benefits – it is environmentally wasteful, and takes homes out of the market, when demolishing existing homes to build new supply. Better utilisation of existing homes doesn’t have this problem.

Conclusion

So why aren’t the above solutions being explored?

Well for two reasons.

Firstly, there are no lobby groups for existing homes, only lobby groups for new supply. Every time a developer sells a home, that home becomes a competitor to the next home the developer wants to sell. So no-one is in the corner fighting for existing homes, even though existing homes make up 98 per cent of all homes in Australia in any given year.

Secondly, so many of the solutions involve taxation decisions. Changing taxes is always contentious, with groups of clear winners and losers. The ALP still seems scarred from losing the 2019 Federal election over franking credit and capital gains tax reforms.

But changes need to be made.

Existing homes need to be part of Australia’s housing solution.

Discover more from Changing Sydney

Subscribe to get the latest posts sent to your email.

1 Comment