What if the NSW planning policy designed to preserve existing affordable housing can lead to the withdrawal of this housing from the market?

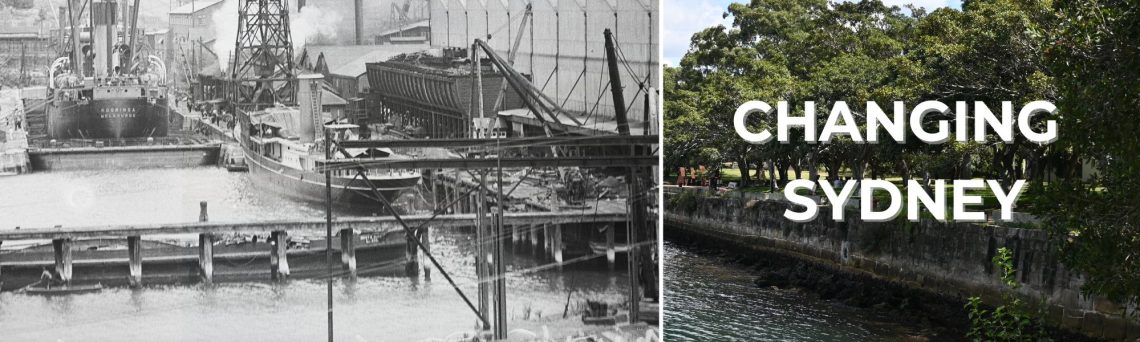

That’s the possible conclusion that can be drawn from the appalling scenario which has seen a unit block at William St, Leichhardt, being left vacant for five years.

Up until April 2019, 16 William St provided affordable rental accommodation across 12 units in a walk-up three storey unit block.

However, according to a letter given by real estate agents to Inner West Council, the last tenants “moved out” of the property on 2 April 2019.

The flat building was then boarded up and fenced.

In other words, the tenants were evicted and the site was deliberately kept vacant.

So why is the date of 2 April 2019 important?

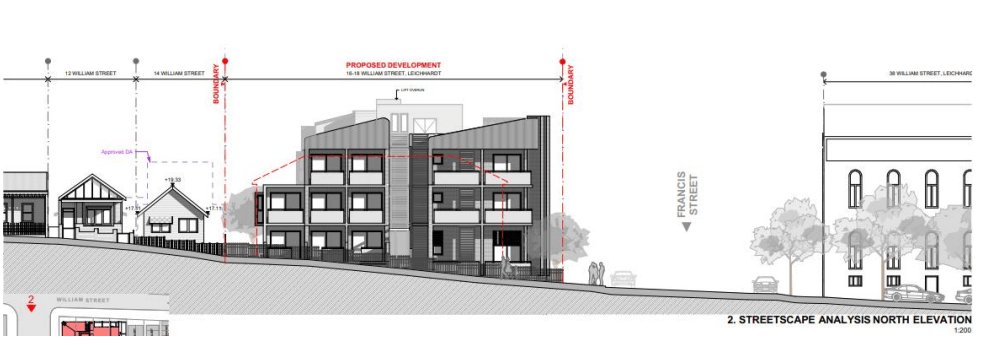

Well that date’s important because, almost exactly five years later in late April 2024, a development application was lodged to demolish the three-storey unit block and instead build four four-bedroom attached dwellings.

And why is that five-year timeframe important?

That timeframe is important because NSW planning rules protecting existing affordable housing do not apply, if the site has not been used for affordable housing in the previous five years before the lodgement of the development application.

“The existing building does not fall within the definition of a ‘low-rental residential building’, as it has been vacant for more than five years and is therefore outside the relevant period,” the April 2024 development application says.

This means the site developer has been able to avoid paying a contribution for causing the loss of reduction of affordable housing on the site, which would have otherwise applied if the application had been lodged within the five year period.

Further, by virtue of the site being vacant for five years, the developer was not required to prove to the council that the destruction of affordable housing was justified.

So, in other words, the site’s landowner has perversely profited from the site being left vacant, at a time of a rising housing crisis when dwellings were desperately needed.

And that’s not the only issue.

The new proposal for the site will also cause a housing affordability issue, by reducing the number of dwellings on the site from 12 to just four.

The application was approved by the Land and Environment Court in February this year, after the developer appealed to the court on the basis that Inner West Council had not made a decision on the application in the required timeframe.

After a conciliation conference, the council and developer came to an agreement and recommended the approval to the court. The issue of the reduction in dwellings was not raised in the court ruling.

The approved plans will allow the construction of four dwellings, each dwelling being two-three storey in height and containing four bedrooms and a study.

Luxury townhouses anyone?

The site owner in fact obtained an approval to build a three-storey 25-room boarding house in 2021, however did not take up this approval and instead progressed the townhouse application.

Research on vacant dwellings

In July, the Parliamentary Research Service released an analysis of the number of vacant homes in NSW, and the approach to vacant home taxes around the world.

The analysis found that long-term vacancy is not well understood, in part because of the lack of data. However, drawing upon three sources of vacancy data in NSW, it found that the total number of inactive, long-term vacant dwellings could be somewhere between 15,000 (0.5% of total dwellings) and 43,185 (1.4%).

“Voluntary long-term vacancies, where dwellings are held vacant for reasons such as speculation for capital growth, are considered problematic in many jurisdictions where housing affordability is an issue,” the research paper said.

“Both ‘carrot’ and ‘stick’ policy responses are being used around the world to deal with long-term vacant housing.

“These policy responses range from tax incentives and dedicated government staff who work with owners to bring vacant housing back into use, to taxation and compulsory requisition or purchase.”

The research paper found that vacant property taxes have been established in 27 jurisdictions around the world.

“Arguments in favour of these taxes include that they are a proportionate response to the lack of adequate housing, and that case studies have shown that they can play an effective role in bringing vacant units back onto the market,” the paper said.

“Arguments against include that the effect of the tax will only be transitory, that the economic costs for owners may be higher than the economic benefits, and that effective enforcement is difficult and costly.”

The situation at William St, Leichhardt would certainly support an argument in favour of a vacancy tax, and changes to planning regulations to discourage property owners from deliberately keeping homes empty to avoid existing affordable housing tests and levies.

It also reinforces the need for regulations to minimise the loss of existing housing supply, a matter which Inner West Council is looking to address through its recently-released planning reforms.

Discover more from Changing Sydney

Subscribe to get the latest posts sent to your email.